It is the income tax that an employer deducts from the salary of the employee. Tax-Deducted At Source (TDS)ĭescription: Tax Deducted at Source. 200 a month which amounts to the maximum payable Rs. Taxability: The maximum amount payable is Rs.

Salary slip copy professional#

Professional Taxĭescription: Professional Tax is a tax that a government levies on professionals based on their salary/monthly income. While calculating the salary the employer deducts the same from the salary.

Salary slip copy full#

Salary Advanceĭescription: When an employee draws in full or portion of salary in advance, it refers to as Salary advance. Taxability: After 15 years of maturity, the full PPF amount can be withdrawn and all is tax-free, including the interest amount as well. Impact on Take-Home Salary: Yes, the employer deducts this amount from the Gross Salary. Under this scheme, the employee makes a stipulated contribution from his salary. Provident Fund (Employee Contribution)ĭescription: Employee Provident fund is a mandatory retirement benefits scheme for salaried employees. DeductionsĮmployee Deductions are the amounts subtracted from an employee’s gross pay to reach net pay. Part of Take-Home Salary: Yes, based on the actual amount an employer pays. Usually, the employer pays such amounts during festive seasons. Companies pay bonuses yearly based on the overall financial performance of the organization or employee performance. Bonus Payĭescription: An employer pays the Bonus pay as a reward pays to his employee for his good work. Part of Take-Home Salary: Yes, based on the actual amount an employee spends on travel for business. Taxability: 2 journeys in a block of four calendar years can be claimed. TA – Travel Allowanceĭescription: Traveling allowance is the amount paid or allotted to an employee by the employer for traveling to another place for business purpose. Special Allowanceĭescription: The special allowance is a fixed allowance given to employees to meet certain requirements over and above the basic salary. Taxability: This amount is exempt up to a maximum of Rs. Medical Allowanceĭescription: The employer credits a fixed amount as a medical allowance along with the salary to the employee’s account every month. Medical allowance is calculated based on applicability to employees as per the contract. 1600 per month or based on the actual amount in your salary slip. Taxability: The income tax allows a maximum exemption of Rs. The employer calculates this allowance based on employee attendance. Conveyance Allowanceĭescription: Allowance or money to compensate for an employee’s travel expenses between their residence and workplace is Conveyance Allowance. Taxability: This allowance is exempted up to a certain limit from income tax. For employees in a metro city, it is 50% of the basic pay whereas employees of a non-metro city it is 40% of the basic pay. It is decided based on different criteria like the city of residence and salary grade. House Rent Allowance (HRA)ĭescription: House Rent Allowance is the amount allocated by an employer to the employee as a portion of their CTC salaries. Taxability: Dearness Allowance is fully taxable for individuals who are salaried employees. DA (Dearness Allowance) is 4% to 10% of basic pay depending on the contract. Government employees, public sector employees, and pensioners get to DA. Dearness Allowanceĭescription: In India, Pakistan, and Bangladesh, employers provide Dearness Allowance A as the cost of living adjustment allowance.

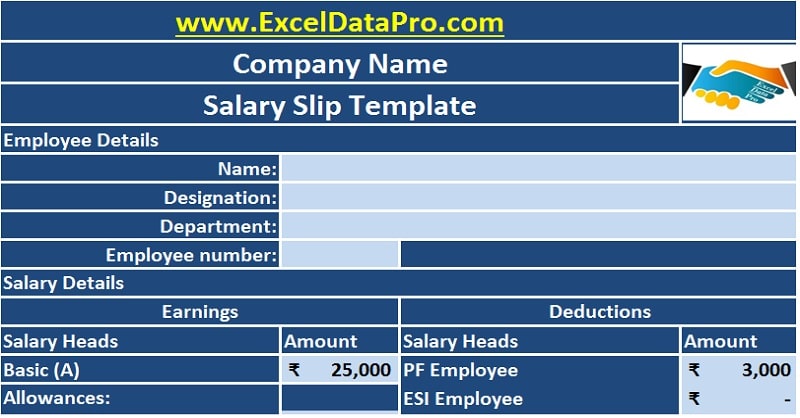

In addition to the basic salary, Allowances are extra financial benefits that employers provide to their employees. Taxability: Basic salary is 100% taxable if it crosses the Income Tax Slabs. Usually, the basic salary is 40-50% of CTC. Basic Salaryĭescription: Basic salary is the fixed amount to be paid to an employee addition of any allowances or subtraction any deductions. There are three major components of the Salary: Basic Pay, Allowances, and Deductions. You just need to enter the payroll data of your employees and print the salary slip. We have created the 9 ready-to-use Salary Slip Templates with predefined formulas. Salary Slip is a payroll document that contains details of salary paid to any employee which include basic salary, allowances, deductions, attendance, leave record, etc. Does higher basic pay increase your tax liability?.

Salary slip copy download#

Download Salary-Slip Template Without Taxes.Download Salary-Slip Template With Taxes.Download Corporate Salary Slip Template.

0 kommentar(er)

0 kommentar(er)